What is the average tax rate in Canada?

Taxes. Ugh, not the most exciting topic, but an important one in Canada, especially when it comes to figuring out how much you get to keep from your hard-earned income. So, if you’ve ever wondered what the average tax rate is in Canada, you’ve come to the right place!

First things first, there’s no single, simple answer to the question of “What’s the average tax rate in Canada?” Here’s why:

- It’s Not Just Federal: Canada has a two-tiered tax system, meaning there’s a federal tax you pay to the national government and a provincial or territorial tax you pay to your local government. This means the total tax you pay depends on where you live.

- Tax Brackets Are a Thing: Canada uses a progressive tax system, which means the more you earn, the higher percentage of your income you pay in taxes. So, someone making a million dollars a year will pay a much higher average tax rate than someone making minimum wage.

- Deductions and Credits Play a Role: The Canadian tax system offers various deductions and credits that can lower your taxable income, which in turn reduces your overall tax bill. These can vary depending on your life situation (think medical expenses, charitable donations, etc.)

Now that we’ve established why there’s no magic “one size fits all” answer, let’s explore some ways to understand average tax rates in Canada:

Looking at the Net Tax Wedge:

The OECD (Organisation for Economic Co-operation and Development) tracks a metric called the “net tax wedge.” This essentially shows how much of your income is taken by taxes and social security contributions, leaving you with your net take-home pay. Here’s what the data tells us for Canada over the last 10 years (2014-2022):

- 2022: The net average tax rate for an average single worker in Canada was 25.6%, which is slightly higher than the OECD average of 24.6%. This means Canadians take home 74.4% of their gross wages after taxes and benefits, compared to the OECD average of 75.4%.

- The Trend: Interestingly, the net average tax rate for single workers in Canada has actually decreased slightly over the past decade. In 2000, it was 36.2% for the OECD and 34.1% for Canada.

Understanding Tax Brackets:

Here’s where things get a little more complex. Let’s take a look at the 2024 federal tax brackets to understand how income affects your tax rate:

- Taxable Income | Federal Tax Rate

- Up to $29,590 | 15%

- $29,590 – $59,180 | 20.50%

- $59,180 – $93,000 | 26%

- $93,000 – $165,430 | 29%

- Over $165,430 | 33%

To visualize this better, let’s imagine Sarah, who makes $65,000 a year. Based on the federal tax brackets, here’s a simplified breakdown:

- Tax on first $29,590: $29,590 x 15% = $4,438.50

- Tax on remaining $35,410 ($65,000 – $29,590): $35,410 x 20.50% = $7,240.05

- Total Federal Tax: $4,438.50 + $7,240.05 = $11,678.55

Remember, this is just the federal portion. Sarah would also need to factor in her provincial tax rate for the total picture.

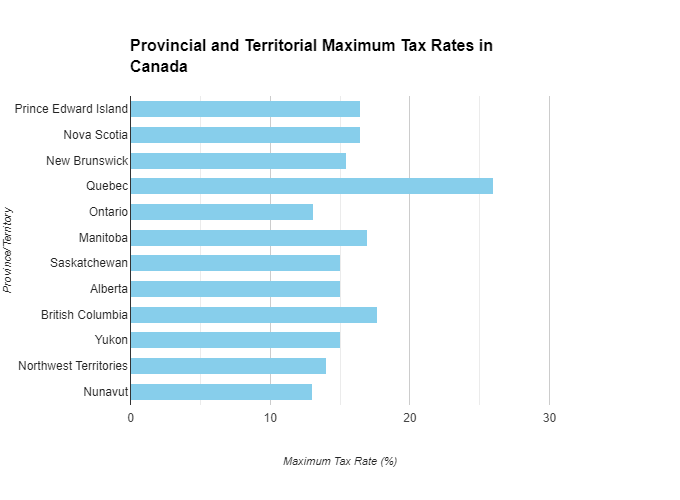

Provincial and Territorial Variations:

As mentioned earlier, provincial and territorial taxes add another layer to the equation. Here’s a range to give you an idea (rates can change, so it’s always best to check the official government websites for the latest information):

Province/Territory | Tax Rate Range

- Newfoundland and Labrador | 10.7% – 15.2%

- Prince Edward Island (continued) | 10.8% – 16.5%

- Nova Scotia | 10% – 16.5%

- New Brunswick | 10.75% – 15.5%

- Quebec | 15% – 26%

- Ontario | 6.45% – 13.1%

- Manitoba | 10.8% – 17%

- Saskatchewan | 10.5% – 15%

- Alberta | 10% – 15%

- British Columbia | 5.06% – 17.7%

- Yukon | 6.0% – 15%

- Northwest Territories | 5% – 14%

- Nunavut | 0% – 13%

Impact of Deductions and Credits:

Remember those deductions and credits we mentioned earlier? They can significantly impact your average tax rate. Here are some common examples:

Basic Personal Amount: This is a non-refundable tax credit that reduces your taxable income. The amount you receive depends on your filing status.

Medical Expenses: You can claim medical expenses that exceed a certain threshold as a deduction, lowering your taxable income.

Charitable Donations: Donations to registered charities can also be deducted from your taxable income.

Education and Training: Certain education and training expenses may qualify for deductions or credits.

By taking advantage of these deductions and credits, you can effectively reduce your average tax rate.

The Canada Revenue Agency website has a wealth of information on these and other tax breaks you may be eligible for.

So, what’s the average tax rate in Canada? As we’ve seen, it depends on a variety of factors – your income level, province of residence, and whether you qualify for any deductions or credits.

Here’s a quick recap:

The net average tax rate for single workers in Canada has hovered around 25% over the last decade.

Federal tax brackets determine a portion of your tax rate based on your income level.

Provincial and territorial taxes add another layer, with rates varying across the country.

Deductions and credits can significantly lower your average tax rate.

Final Thoughts:

Taxes may not be the most exciting topic, but understanding how they work can empower you to make informed financial decisions. By taking advantage of tax breaks and planning effectively, you can minimize your tax burden and keep more of your hard-earned money in your pocket.