Tax Tips for First Time Home buyers in Canada and the U.S.

Becoming a first-time homebuyer is exciting, but it can also be overwhelming, especially when it comes to navigating taxes. Whether you’re in Canada or the U.S., there are various tax benefits and credits available that can help you save money and make homeownership more affordable. In this guide, we’ll break down key tax tips for first time home buyers in both countries, providing you with essential information to maximize your savings and reduce the financial burden.

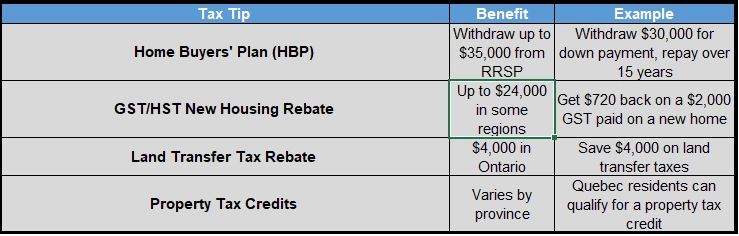

Canada: Tax Tips for First Time Home buyers

As a first-time homebuyer in Canada, there are several tax benefits and programs that you can take advantage of. Here’s a breakdown of the most common ones:

1. Home Buyers’ Plan (HBP)

The Home Buyers’ Plan (HBP) allows first-time homebuyers to withdraw up to $35,000 from their RRSP (Registered Retirement Savings Plan) to use as a down payment on their home. The best part? You won’t face immediate taxes on these withdrawals, provided you repay the amount over the next 15 years.

Example: If you withdraw $30,000 from your RRSP, you would need to repay that amount within 15 years, starting the second year after the withdrawal.

2. GST/HST New Housing Rebate

When purchasing a new home, you may be eligible for the GST/HST New Housing Rebate. This rebate helps reduce the amount of GST or HST you pay on a new home.

Example: If you purchase a new home and pay $2,000 in GST, you could receive a rebate of $720 (depending on your region and the cost of the home).

3. Provincial and Territorial Programs

Canada also has provincial and territorial programs for first-time homebuyers. These include land transfer tax rebates and first-time homebuyer grants, which vary by location. For example, Ontario offers a land transfer tax rebate of up to $4,000.

4. Property Tax Deductibility

In Canada, property taxes are generally not deductible unless you’re self-employed and using part of your home as a business space. In that case, you might be able to deduct a portion of your property taxes related to your home office.

Data Tables for Quick Reference

Canada: Key Tax Tips for First Time Home buyers

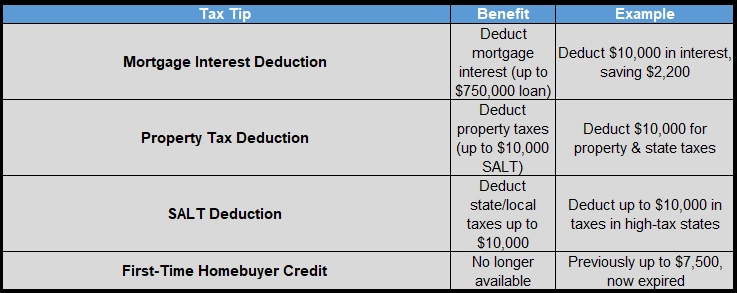

United States: Tax Tips for First Time Home buyers

First-time homebuyers in the U.S. also enjoy several tax advantages. Here’s what you need to know:

1. Mortgage Interest Deduction

In the U.S., you can deduct mortgage interest on your tax return, which can result in significant savings. The maximum mortgage eligible for this deduction is $750,000 (for loans taken after 2017; it was $1 million before). This deduction is available to homeowners who itemize their deductions on Schedule A.

Example: If you pay $10,000 in mortgage interest and are in the 22% tax bracket, you could save $2,200 on your taxes.

2. Property Tax Deduction

Homeowners can also deduct property taxes on their federal tax returns, but keep in mind that the SALT deduction (State and Local Tax Deduction) is limited to $10,000.

Example: If you pay $8,000 in property taxes and $2,000 in state income taxes, you can deduct the full $10,000.

3. State and Local Tax (SALT) Deduction

The SALT deduction allows you to deduct state and local taxes up to $10,000. This deduction is especially helpful in states with high taxes like California, New York, and New Jersey.

4. First-Time Homebuyer Credit (No Longer Available)

Previously, first-time homebuyers could receive a tax credit of up to $8,000. However, this credit expired in 2010, so it’s no longer available.

Data Tables for Quick Reference

U.S.: Key Tax Tips for First-Time Home buyers

Common Tax Considerations for Both Countries

While each country has its specific tax benefits, there are some common tax considerations to keep in mind:

1. Record Keeping

Whether you’re in Canada or the U.S., maintaining detailed records of your home purchase, mortgage interest payments, property taxes, and any other home-related expenses is crucial. You may need these records to claim deductions and rebates during tax season.

2. Professional Advice

Tax laws can be complicated, so consulting a tax professional is always a good idea. A qualified expert can help you understand your specific situation and ensure you’re maximizing your available benefits.

3. Tax Law Changes

Tax laws are subject to change, so make sure you’re aware of any updates that could affect your tax situation. In both Canada and the U.S., tax benefits related to homeownership can shift with new legislation.

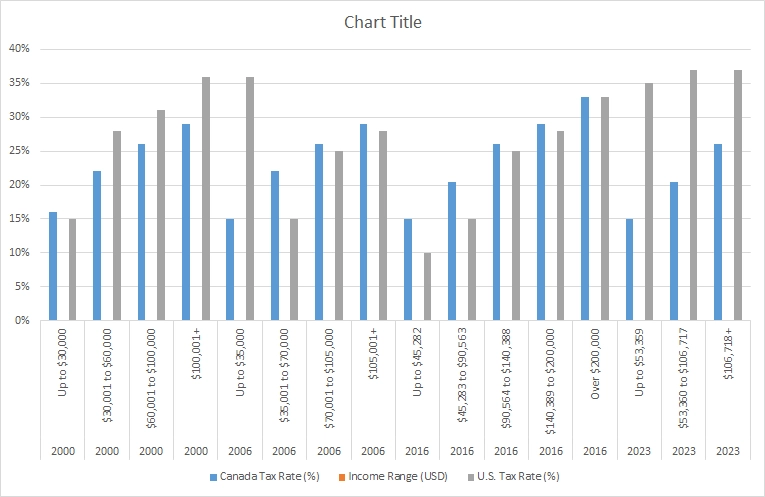

Tax Slabs Comparison for Canada and the U.S.

Here’s a quick comparison of tax brackets in Canada and the U.S. from 2000 to the present. This table will help you see how tax rates have evolved.

Combined Tax Slabs for Canada and the U.S. (2000 – Present)

Conclusion

Buying your first home is an exciting milestone, and with the right tax strategies, you can make the process a lot easier. By understanding the tax benefits available in both Canada and the U.S., you can save money on your purchase and throughout your homeownership journey.

Remember, whether you’re in Canada or the U.S., there are plenty of opportunities to take advantage of homebuyer-specific tax credits and deductions. Always keep detailed records, consult a tax professional when in doubt, and stay informed about changes in tax laws. Your tax savings could make a significant difference in your homebuying journey.

Frequently Asked Questions (FAQs)

What is the Home Buyers’ Plan (HBP) in Canada?

The Home Buyers’ Plan (HBP) allows first-time homebuyers to withdraw up to $35,000 from their RRSP (Registered Retirement Savings Plan) to use as a down payment on their home. The best part is that there are no immediate tax consequences, and the amount must be repaid over a period of 15 years.

How much can I save through the GST/HST New Housing Rebate in Canada?

The GST/HST New Housing Rebate can help you recover a portion of the GST/HST you paid on the purchase of a new home. Depending on your region, this rebate can be up to $24,000. For example, if you paid $2,000 in GST, you may be eligible for a rebate of $720.

Can I claim mortgage interest as a deduction in Canada?

Mortgage interest is generally not deductible in Canada, unless you are using part of your home for business purposes. In that case, you might be able to deduct a portion of your mortgage interest and property taxes related to your home office.

What tax benefits do first-time homebuyers get in the U.S.?

In the U.S., first-time homebuyers can benefit from several tax deductions. The most notable ones are:

- Mortgage Interest Deduction: You can deduct mortgage interest (up to $750,000) on your federal taxes.

- Property Tax Deduction: Property taxes can also be deducted on Schedule A.

- SALT Deduction: You can deduct state and local taxes up to $10,000.

What is the SALT deduction in the U.S.?

The State and Local Tax (SALT) Deduction allows U.S. homeowners to deduct state and local taxes, including property taxes, from their federal income taxes. However, this deduction is capped at $10,000 due to the Tax Cuts and Jobs Act.

Is there still a First-Time Homebuyer Credit in the U.S.?

The First-Time Homebuyer Credit was available in the past, but it expired in 2010. This credit provided up to $8,000 in savings for eligible first-time buyers, but it is no longer available.

Can I deduct property taxes in Canada?

Property taxes are generally not deductible in Canada unless you are self-employed and using part of your home as an office. In that case, you may be able to deduct a portion of the property taxes related to the home office space.

How do provincial and territorial programs affect first-time homebuyers in Canada?

Each province and territory in Canada offers its own set of incentives and programs for first-time homebuyers. For example, Ontario provides a land transfer tax rebate of up to $4,000, and Quebec offers a property tax credit for residents. It’s important to research what programs are available in your specific province or territory.

How does the Mortgage Interest Deduction work in the U.S.?

The Mortgage Interest Deduction allows you to deduct the interest you pay on a mortgage for your primary home (and sometimes a second home) from your federal taxes. This deduction is available only if you itemize your deductions on your tax return. You can deduct interest on loans up to $750,000 for homes bought after 2017.

What are the tax implications of using the Home Buyers’ Plan in Canada?

While you can withdraw up to $35,000 from your RRSP under the Home Buyers’ Plan without paying taxes immediately, you must repay the amount within 15 years. If you fail to make the required repayments, the amounts are added back to your income and taxed.

Are there any tax benefits for homebuyers in Canada who make energy-efficient upgrades?

Yes, if you make energy-efficient improvements to your home, such as installing solar panels or upgrading insulation, you may qualify for certain tax credits or deductions. Additionally, some provinces offer rebates or credits for energy-efficient home upgrades.

Can I still benefit from tax savings if I’m buying a home with a partner or spouse in either Canada or the U.S.?

Yes, you can still benefit from most tax advantages if you’re purchasing a home with a partner or spouse. For example, in both Canada and the U.S., deductions such as mortgage interest and property taxes can be split between both individuals if you file jointly or have shared expenses. Be sure to consult with a tax professional for specific guidance.

How can I ensure I’m making the most of the tax benefits available to first-time homebuyers?

To make the most of available tax benefits, keep detailed records of all expenses related to your home purchase, including mortgage interest, property taxes, and home improvements. Consult with a tax professional to understand how each benefit applies to your unique situation, and ensure you’re filing correctly.

Do tax laws change often for homebuyers?

Yes, tax laws can change frequently. Both Canada and the U.S. adjust their tax laws regularly, so it’s important to stay informed about new rules that might affect homeownership. For example, changes in the U.S. tax code or Canadian rebate programs could impact your eligibility for certain benefits.