Rising Home Insurance Rates: Tax Impacts & Savings Tips

Have you noticed your home insurance premiums creeping up every year? If so, you’re not alone. In 2024, homeowners across the United States and Canada are facing an average increase of over 17%, leaving many homeowners wondering why their insurance costs are rising and what they can do about it.

These hikes aren’t just a result of bad luck or random pricing shifts. In fact, they are part of a much larger trend shaped by climate change, inflation, and increasing natural disasters. If you’re feeling the pinch, you’re probably looking for ways to manage this growing expense. But what if there’s more to this than just saving on premiums? What if your home insurance costs could also impact your tax bill?

In this article, we’ll dive into the rising costs of home insurance, explore the potential tax implications, and share some practical strategies to save on both premiums and taxes. Whether you’re trying to lower your insurance rates or understand the connection between insurance and your taxes, we’ve got you covered.

The Rising Cost of Home Insurance: Why It’s Happening

Home insurance rates have been steadily climbing, and it’s a trend that’s likely to continue in the near future. Let’s take a look at some of the key factors behind this increase.

1. Inflation and Rising Costs

The cost of materials and labor continues to rise due to inflation, and this directly impacts your home insurance premiums. Insurance companies use these costs to determine the price of policies, which means higher construction and repair costs are reflected in your premiums.

2. Increasing Natural Disasters

Natural disasters such as wildfires, hurricanes, floods, and severe storms are more frequent than ever. In regions like California, Florida, and Texas, these disasters have led to record-breaking insurance claims. As insurance companies face more payouts, they raise premiums to cover their losses.

3. Climate Change

The effects of climate change are becoming impossible to ignore. Areas that were once considered low-risk for natural disasters are now facing significant threats. For example, homeowners in parts of the Midwest and even the Northeast are seeing higher premiums as insurers adjust to changing weather patterns.

4. Regional Variations in Insurance Rates

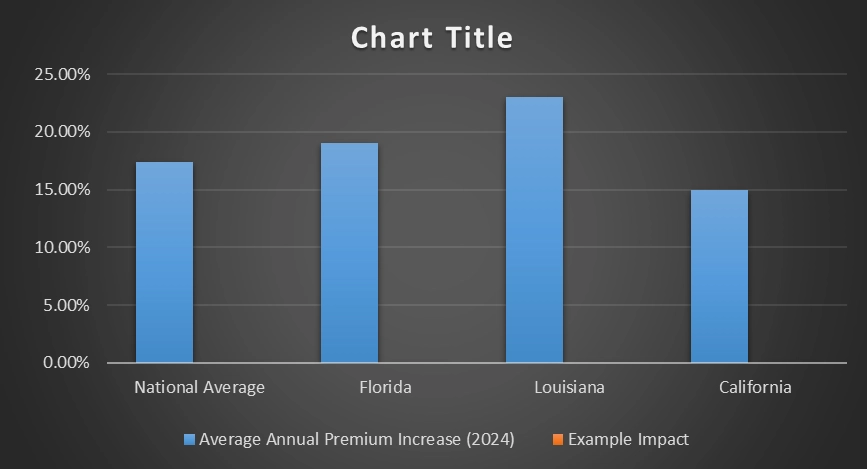

Some states and regions are experiencing even more drastic increases in home insurance premiums. Let’s look at the data for a clearer picture.

Data Insight: National Trends & Regional Variations

Here’s a breakdown of how home insurance premiums have been increasing in 2024:

National Average: 17.4% increase – General rise in premiums.

Florida: 19% increase – Increased risk of natural disasters.

Louisiana: 23% increase – Higher hurricane risk.

California: 15% increase – Wildfires impacting premiums.

As you can see, some areas are seeing much larger increases due to specific environmental and regional risks.

How Rising Insurance Costs Impact Your Taxes

Rising home insurance premiums not only impact your wallet but could also have implications for your taxes. Let’s break it down.

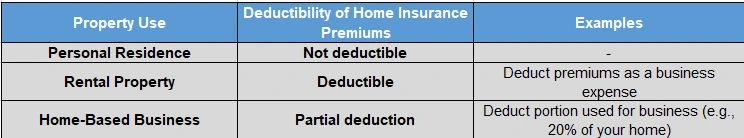

1. Deductibility of Home Insurance Premiums

In most cases, homeowners cannot directly deduct their home insurance premiums on their personal taxes. However, there are exceptions depending on how you use your property.

2. Tax Savings Potential

Even if you don’t directly deduct your premiums, understanding how home insurance impacts your tax situation can help you make better financial decisions.

Here’s an example of how tax savings work:

For a homeowner in the 22% tax bracket, a $2,000 premium deduction would result in $440 in federal tax savings.

3. Tax Burden vs. Deductions

If your home insurance premiums increase significantly, you might find yourself spending more on property-related deductions, but you could also face diminishing returns when you itemize your deductions. This happens because the total deductions might reach a point where the benefit becomes less significant, especially if other deductions (e.g., mortgage interest or property taxes) remain stable.

Strategies to Manage Rising Home Insurance Costs and Tax Impacts

Feeling overwhelmed by rising premiums and tax complexities? Don’t worry! There are several strategies you can implement to manage your costs more effectively.

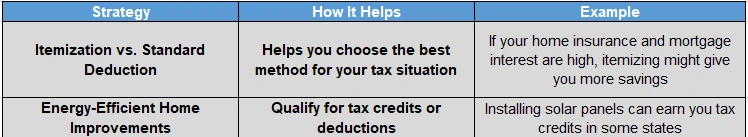

1. Maximize Tax Deductions

- Itemization vs. Standard Deduction: If your premiums are going up, check if itemizing is worth it. If your expenses like mortgage interest are high, itemizing may save you more, but the standard deduction might still be better for some.

- Energy-Efficient Home Improvements: Upgrading to energy-efficient features like solar panels can get you tax credits or deductions, saving you money on both your bills and taxes.

2. Increase Your Deductible

One of the most straightforward ways to reduce your insurance premium is by increasing your deductible. While this means you’ll pay more out-of-pocket if you need to file a claim, it can significantly lower your annual premium.

3. Improve Home Security

Did you know that installing security features like alarm systems, smart locks, or fire detectors could help lower your insurance premiums? Insurance companies often offer discounts for homes with higher security, as they are seen as less risky to insure.

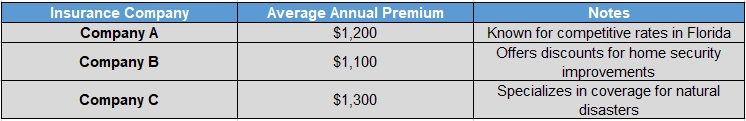

4. Shop Around for Better Rates

Don’t assume your current provider is offering the best rate. Premiums can vary significantly between companies, so it’s worth shopping around and comparing quotes annually to find better coverage at a lower price.

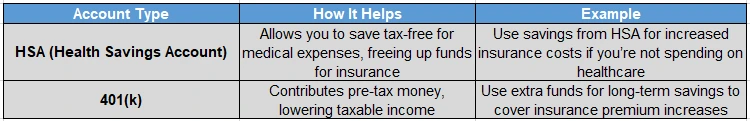

5. Consider Using Tax-Advantaged Accounts

If you’re feeling the pinch, consider utilizing tax-advantaged savings accounts such as HSAs or 401(k)s. These accounts can free up funds for other needs, including your insurance premiums. You can also use your IRA or 401(k) funds for long-term savings to absorb some of the increasing costs of insurance.

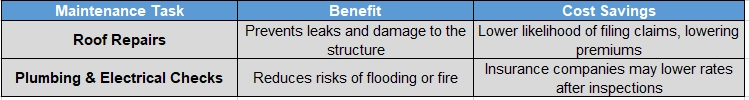

6. Regular Home Maintenance

Regular home maintenance can help prevent costly repairs, which means fewer claims and potentially lower premiums. Keeping your roof, plumbing, and electrical systems in check can reduce your home’s risk, which insurers love to see.

Conclusion: Take Control of Rising Home Insurance Costs

Rising home insurance premiums are undeniably a financial challenge, but understanding the tax implications and applying smart strategies can help you manage the impact. By maximizing deductions, shopping for better rates, and implementing cost-saving measures, you can not only protect your home but also protect your wallet.

Have you noticed your premiums rising recently? What strategies have worked for you in managing those costs? Share your thoughts in the comments below!

Proactive financial planning is the key to navigating these increases without letting them take a toll on your finances. With the right approach, you can ensure that both your home and your budget stay secure.

FAQs:

Can I deduct my home insurance premiums on my taxes?

- Generally, home insurance premiums are not deductible if the property is your primary residence. However, if you use your home for a rental property or a home-based business, you may be able to deduct a portion of the insurance premiums as a business expense.

How do rising home insurance premiums affect my taxes?

- While rising premiums themselves are not directly tax-deductible for personal residences, they can indirectly affect your tax situation. If your overall home expenses (including insurance) increase, it may reduce the benefit of itemized deductions, particularly if your total deductions don’t exceed the standard deduction.

Can I deduct home insurance premiums for rental properties?

- Yes! If you own rental property, you can deduct home insurance premiums as part of your property expenses, as they are considered a necessary cost for maintaining the rental property.

What tax benefits can I expect if my insurance premiums increase?

- For those who itemize deductions, increasing home insurance premiums might slightly lower your overall tax bill since they are part of your total property-related expenses. However, your overall deductions need to exceed the standard deduction to benefit from itemizing.

Do I get tax savings from home insurance if I increase my deductible?

- Increasing your deductible can lower your annual premiums, but it doesn’t directly impact your tax situation. However, if it leads to a significant reduction in premiums, you might be able to allocate those savings toward other tax-saving opportunities.

How can I reduce my tax burden with rising home insurance premiums?

- Consider maximizing other home-related deductions, such as mortgage interest, property taxes, and potential energy-efficient home improvement credits. Additionally, if you have a home-based business, you might be able to deduct a portion of your home insurance premiums as a business expense.

Is there any way to claim a deduction for home insurance premiums on my taxes if I live in a disaster-prone area?

- If you live in an area that is prone to disasters and your insurance premiums increase as a result, you may qualify for certain disaster-related tax deductions. For example, if you suffer significant damage from a natural disaster, the costs of repairs may be deductible, but only if they exceed a certain threshold.

How do rising premiums affect the itemized deduction threshold?

- As home insurance premiums rise, your overall property-related expenses increase, which may push you closer to the threshold where itemizing deductions is more beneficial than taking the standard deduction. However, if your total deductions don’t exceed the standard deduction, itemizing may not provide a significant tax benefit.

Can tax-advantaged accounts help me offset the rising cost of home insurance premiums?

- While tax-advantaged accounts like HSAs or 401(k)s don’t directly affect your home insurance premiums, they can free up funds for other financial needs, allowing you to cover rising premiums without sacrificing other areas of your financial plan.

Are there any special tax credits for making my home more resilient to rising insurance costs?

- Certain energy-efficient home upgrades or disaster mitigation efforts (like installing a new roof or storm shutters) may qualify for tax credits in some areas. These improvements can not only lower your risk, potentially reducing premiums but may also provide you with tax-saving opportunities.